Egypt has not yet introduced a broad, economy‑wide “Environmental Tax Policy” or explicit “carbon tax for 2025”, but it is tightening pollution‑related fees in specific sectors, especially waste and plastics, while pairing this with strong incentives for green projects. Egypt’s current “Environmental Tax Policy” 2026 tax reforms focus on general tax incentives for small enterprises and VAT updates, and widespread environmental taxes.

Some research and policy discussions mention the potential benefits of environmental taxes in the Egyptian context to incentivize cleaner production, this appears to be part of ongoing general policy discussions rather than a concrete, implemented law for 2026.

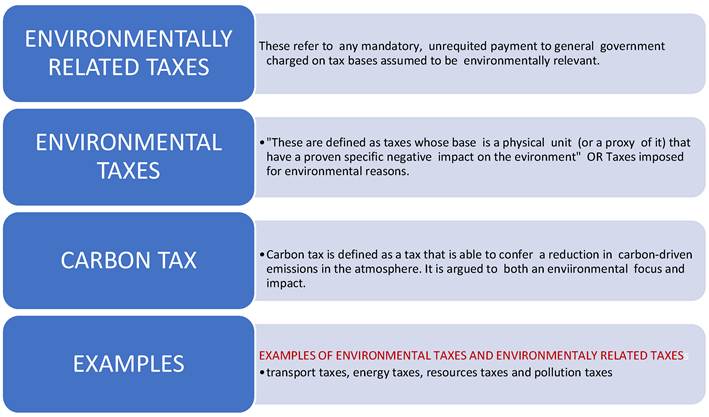

Image Source: mdpi

For most industries, the main new, concrete pollution‑linked levy in 2026 is the Extended‑Producer‑Responsibility (EPR) Fee on single‑use plastic bags, alongside stricter environmental permitting, self‑monitoring and reporting duties that increase compliance and potential fee exposure.

Egyptian Industries Must Know

Existing Regulations: Egyptian industries must continue to comply with existing environmental protection laws and regulations, which enforce penalties for violations.

Future Possibility: The concept of using economic instruments like environmental taxes is discussed in policy analysis as a potential tool for sustainable development. Industries should monitor future legislative developments as Egypt works towards its Vision 2030 goals and climate commitments.

Carbon Markets: Egypt is also involved in developing carbon market mechanisms, which could affect certain industries in the future.

Current tax and fee landscape

Egypt still does not have a general environmental tax on pollution, natural resource use, or an explicit nationwide carbon tax; instead, it relies on targeted charges and regulatory instruments for specific pollutants and sectors.

The government has been advised by international partners to expand the use of pollution taxes and transport‑related environmental charges to strengthen both environmental and fiscal sustainability.

2025 Plastic EPR Environmental Tax Policy

From 3 June 2025, producers of single‑use plastic shopping bags must pay fees to government entities to cover safe collection and disposal of waste from these bags under the Waste Management Law, effectively functioning as a pollution‑linked fee based on quantities placed on the market. Producers are expected to register in an online system, report volumes transparently, and could face enforcement risks if they under‑declare or fail to enrol.

Environment Tax Regulatory Industries Must Know: Cost Drivers

Amendments to the executive regulations of the Environment Law approved in 2025 require industrial‑area authorities and establishments to prepare detailed pollution‑load studies, integrated environmental management plans, and robust self‑monitoring systems for air, noise and wastewater.

Facilities must keep paper and electronic environmental records, immediately notify the Egyptian Environmental Affairs Agency of exceedances, and report annually on discharge rates and pollutant concentrations. For industrial clusters, authorities must also ensure compatible land‑use and activity distribution to avoid cumulative pollution impacts, which may affect permitting and expansion decisions.

High‑pollution sectors such as cement, plastics, petrochemicals, and waste‑intensive manufacturing will remain under pressure. Companies in these industries should anticipate further fee‑based instruments, such as expanded EPR schemes, higher waste‑disposal charges, or targeted emission levies, and plan for tighter monitoring, disclosure, and potential price‑pass‑through strategies.

“These obligations increase the indirect “cost of pollution” by tightening compliance expectations and creating clearer grounds for administrative fees, penalties, and mandated corrective investments if standards are breached.”

Sectoral Incentives and Exposure

The government is simultaneously using tax incentives to steer capital into low‑emission activities, notably green hydrogen and its derivatives. Green hydrogen projects can receive a cash investment incentive equal to 33–55% of the income tax due on project profits, and key machinery and inputs are exempt from VAT, while exports are zero‑rated.

Sectors Facing New Environmental Tax Policy Under

Egypt’s 2026 Rules

Under Egypt’s 2026 Policy, the new explicit pollution‑linked fee mainly targets producers and importers of single‑use plastic shopping bags, but the regulatory changes also tighten environmental obligations for a wider set of industrial and commercial operators. Plastics manufacturers, bag converters, importers, and large retailers that place branded plastic shopping bags on the Egyptian market are directly in scope for the new waste‑disposal fee, while operators in industrial zones face stricter monitoring and reporting that can raise their exposure to environmental charges and penalties.

Image Source: linkedin

Directly Fee‑Paying Sectors in 2026

Producers and importers of plastic shopping bags that meet Egyptian Standard Specifications are required to register in the national waste information system and pay 37.5 EGP per kilogram of bags sold domestically to fund safe disposal under the Waste Management Law.

Industrial Operators Under Tighter Controls

It is mandatory now for establishments in industrial areas to provide pollution‑load studies, environmental management plans, and self‑monitoring schemes for air, noise, and wastewater, with mandatory record‑keeping and reporting to the Environmental Affairs Agency.

This reporting make it easier for authorities to apply, adjust, and enforce fees, penalties, or required mitigation investments linked to actual emissions and waste.

Effects of EPR Fees on Small Retailers and Informal Sellers

The 2025 the Environmental Tax on single-use plastic bags in Egypt primarily target producers and importers, not small retailers or informal sellers directly.

Image Source: 500earth

The cost impact will indirectly reach them because:

This cost will likely be passed down the supply chain to retailers, including small and informal sellers, as part of the purchase price of plastic bags.

Small retailers and informal sellers do not pay EPR fees directly, but will experience indirect financial effects, which may be passed on to consumers through charging for bags or raising product prices.

The policy encourages consumers to reduce plastic bag use by making the cost more visible and incentivizing alternatives like reusable bags.

How Enforcement and Inspections Will Target Informal Market Sales

Enforcement and inspections targeting informal market sales in Egypt under the new Environmental Tax Policy and pollution control rules will be challenging due to the nature of the informal sector.

Best practices and emerging models from other contexts suggest several likely approaches:

Enforcement will likely combine market organization, vendor registration, multi-agency inspections, awareness programs, and gradual formalization strategies to effectively address informal market compliance with Egypt’s environmental policies and fees.

- Authorities will increasingly emphasize mapping and formal registration of informal vendors to better understand their locations and activities, creating a foundation for monitoring and enforcement.

- Designated vending sites and improved stall designs might be introduced to organize informal sellers into manageable, sanitary, and safer spaces, enabling inspections and compliance checks more effectively.

Image Source: linkedin

- Enforcement will likely involve cooperation across multiple government departments including environmental, health, municipal, and law enforcement agencies, with regular inspections and training or awareness-raising activities for informal sellers about compliance expectations and waste reduction.

- Enforcement efforts may primarily focus on preventing public health and safety risks, controlling nuisance behaviors, and promoting proper waste disposal rather than immediate punitive actions, especially in early phases.

- Informal sector enforcement is often gradual, aiming to integrate informal sellers into more formal, compliant systems over time rather than immediate formalization, to balance regulatory goals with livelihoods.

Inspections Verification for EPR Fee Collection at Point Of Sale

Inspections to verify Environmental Tax- EPR fee collection at the point of sale in Egypt will likely rely on a combination of registration systems, reporting requirements, and supply chain traceability measures similar to those applied in other jurisdictions with EPR frameworks.

Producers and importers of single-use plastic bags must register with the relevant environmental authority and report volumes of plastic bags sold domestically in an online system.

Authorities may conduct physical inspections and audits at production sites, warehouses, and large retailers to verify records, compare declared volumes against actual inventory and sales, and check compliance with registration and tax payment obligations.

Electronic tracking and reporting systems are often required to track procurement, sales transactions, and fee payments digitally, enabling regulators to cross-check data and flag discrepancies for investigation.

Random inspections or risk-based targeting of points of sale, especially larger commercial outlets and wholesale markets, could assess whether vendors are sourcing bags from registered suppliers complying with EPR fee payments.

Some systems include mandatory documentation (invoices, shipment records) that points of sale must keep and make available to inspectors to demonstrate compliance with EPR fee obligations.

Image Source: afrisetup

“Verification of EPR fee collection will combine mandatory registration and reporting by producers, digital supply chain monitoring, and targeted enforcement inspections at production and wholesale levels. Smaller retailers and informal sellers will mainly be monitored through the upstream supply chain and awareness efforts.”

Penalties Applied, If Auditors Find Missing or Incorrect Environmental Tax Records

In Egypt for missing, incorrect, or falsified EPR fee records under the environmental fees regime, the following penalties and consequences are likely based on analogous regulatory frameworks and enforcement practices:

Financial penalties can be imposed including fines proportional to the severity of non-compliance.

Daily penalties for delays, and additional compensatory charges possibly doubling or multiplying the original fee amounts.

Violations such as providing false or misleading information in reports or registrations may lead to immediate cancellation of EPR registration and temporary or permanent bans on operating under the EPR framework.

Repeat offenses attract escalating penalties including higher fines, longer suspensions of registration, and potentially permanent revocation of the right to participate in the EPR system, causing significant business disruption.

Fraud or misrepresentation there may be additional administrative and legal consequences including stricter scrutiny, audits, and potential legal actions depending on severity and intent. Companies and responsible officers could face reputational damage, difficulties in bidding for government contracts, and increased compliance monitoring.

15

Image Source: https://vcfoconsulting.com/

“Businesses should maintain accurate, strong record-keeping, transparent reporting, and proactive compliance are essential to avoid these risks.”

Timeline and Process for Penalty Notices and Recovery Actions

Penalty notices and recovery actions for missing or incorrect EPR fee records in Egypt will likely follow a structured administrative process with defined timelines, based on general debt and tax recovery practices.

Initial notification often starts with a penalty or demand notice issued soon after the audit or inspection discovers discrepancies, typically within weeks to a month of the finding. The notice will detail the amount due, the basis for the penalty, and instructions for compliance or appeal.

The entity usually has a defined deadline to respond to the notice, often 15 to 30 days, during which they can remediate errors, pay the penalty, or submit objections and supporting documents.

If the penalty or fee is unpaid after deadline without satisfactory resolution, authorities may begin recovery actions such as administrative collection procedures, lien, or withholding of permits. This stage may last several months depending on cooperation and complexity.

In case of continued non-compliance or dispute, legal proceedings such as formal show-cause notices, adjudication hearings, or court enforcement can follow, extending timelines but also increasing pressure for resolution or further penalties.

“Overall, early stages of penalty and recovery enforcement emphasize remediation and compliance, with escalation to stricter recovery or legal steps only after initial deadlines expire without satisfactory resolution.”

Key Tax Updates in Egypt for 2026

The major tax legislation introduced in Egypt for 2026 includes:

Law No. 6 of 2025: Introduces a simplified tax system and incentives, primarily for small enterprises with a turnover not exceeding EGP 20 million annually, to encourage formal registration and compliance.

Law No. 157 of 2025: Amends the existing VAT Law No. 67 of 2016, introducing significant updates on certain goods and services, such as cigarettes, alcoholic products, and contracting/construction services, to broaden the tax base.

Summary

Egypt’s 2025 Environmental Tax Policy aims to encourage Green‑Economy Strategy, emphasizes regulations and incentives around waste management, alternatives to plastics, and cleaner fuels- including use of refuse‑derived fuel in cement.

Join Us!

Join us and unlock a world of online courses in Mechanical Engineering, Occupational Health and Safety, Fire Safety, and Environment and Sustainability. Propel your career to new heights.

Propel your career to new heights.

Connect now and take the next step toward professional excellence!

+91 7569034271

Let’s connect together on: Facebook, YouTube, LinkedIn, and Instagram.