Hydrogen Strategies in The Middle East and North Africa (MENA) region signify a paradigm shift, from being hydrocarbon exporters to becoming global leaders in zero-carbon energy solutions. These strategies aim to leverage the region’s natural advantages while aligning with global carbon sequestration goals. The MENA region has long been synonymous with oil and gas production, but in recent years, governments and energy stakeholders have been actively developing hydrogen strategies as part of a shift towards sustainable, low-carbon economies.

By leveraging renewable energy, fossil fuel expertise, and strategic investments, the MENA region is set to play a pivotal role in the global hydrogen economy. While challenges remain, strong government commitments and international collaborations are accelerating the transition toward a low-carbon future.

Strategic Ground for Hydrogen in the MENA Region

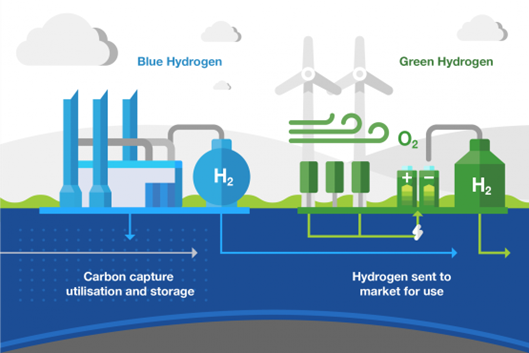

The MENA region, with its vast fossil fuel resources, is positioning itself as a future powerhouse for clean hydrogen. Amid the global push for decarbonization and net-zero emissions, hydrogen—especially green (from renewables) and blue (from natural gas with carbon capture) is emerging as a central pillar in MENA’s energy transitions.

Image Source: sheaws

Key Factors to Implement the Hydrogen Strategies:

The MENA region is investing in hydrogen for several reasons:

Abundant Renewable Resources: The region has many of the world’s highest solar irradiation and significant wind potential, critical for cost-competitive green hydrogen production.

Strategic Export Positioning: Proximity to Europe and Asia, both seeking large-scale hydrogen imports, gives MENA a logistical advantage.

Economic Diversification: The Middle East and North Africa countries’ economies remain heavily dependent on hydrocarbons. Hydrogen provides a pathway to diversify industrial bases, attract investment, and create new export markets, foster new industries, jobs, and technological leadership.

Energy Transition & Climate Goals: Many MENA countries have pledged to reach net-zero emissions by mid-century. Hydrogen—particularly green hydrogen, is central to their plans.

Global Energy Positioning: Given rising demand for low-carbon hydrogen in Europe, Asia, and elsewhere, MENA’s geographic proximity and trade ties make it strategically poised to become a leading hydrogen exporter.

Abundant Renewables: Solar power: The region has some of the highest solar irradiation levels in the world. Wind power: Particularly in North Africa (e.g., Morocco, Egypt) and along the Red Sea.

These allow for competitive renewable electricity, the foundation for green hydrogen production.

Existing Hydrocarbon Infrastructure: Countries like Saudi Arabia, UAE, and Qatar have extensive energy export infrastructure—ports, pipelines, and storage—that can be repurposed or adapted for hydrogen and derivatives like ammonia.

Financial Resources & Sovereign Wealth Funds: Deep pockets allow governments to invest heavily in large-scale, cutting-edge hydrogen projects.

Future Outlook: The MENA region is poised to become a major hydrogen supplier, with:

2030 Targets: Saudi Arabia (4 million tons/year), UAE (25% global market share).

2050 Vision: Green hydrogen could meet 10-15% of global demand from MENA.

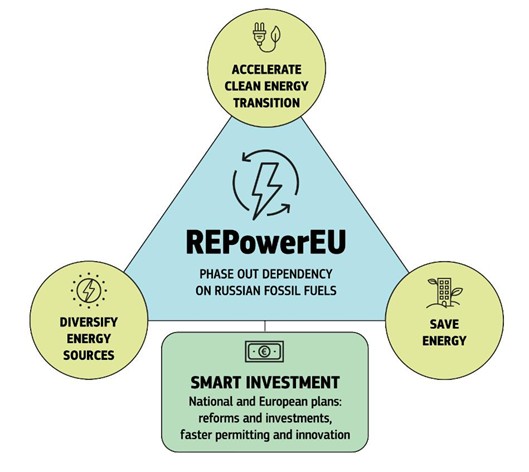

Global Partnerships: EU’s REPowerEU plan and Japan’s hydrogen roadmap rely on MENA imports.

Image Source : eur-lex.europa

Country-Level Developments

Saudi Arabia:

Flagship project: NEOM Green Hydrogen Project, one of the world’s largest, producing green hydrogen/ammonia for export by 2026.

Vision 2030 includes hydrogen as a pillar for clean energy and economic diversification.

Aims to become a top global hydrogen exporter. The NEOM project includes a $5 billion plant (a joint venture with Air Products and ACWA Power) planning to export green ammonia by 2026.

United Arab Emirates (UAE):

Launched a National Hydrogen Strategy targeting leadership in hydrogen by 2031.

Planned clusters in Abu Dhabi, Dubai, and Sharjah to produce hydrogen and derivatives.

United Arab Emirates (UAE): Launched a national hydrogen leadership roadmap, with ADNOC, Masdar, and Mubadala leading green and blue hydrogen projects, as well as partnerships for hydrogen corridors to Europe and Asia.

Oman:

Positioned as a serious hydrogen hub, with Hydrogen Oman (Hydrom) managing projects.

Several gigawatt-scale projects announced with international partners on its coastal regions.

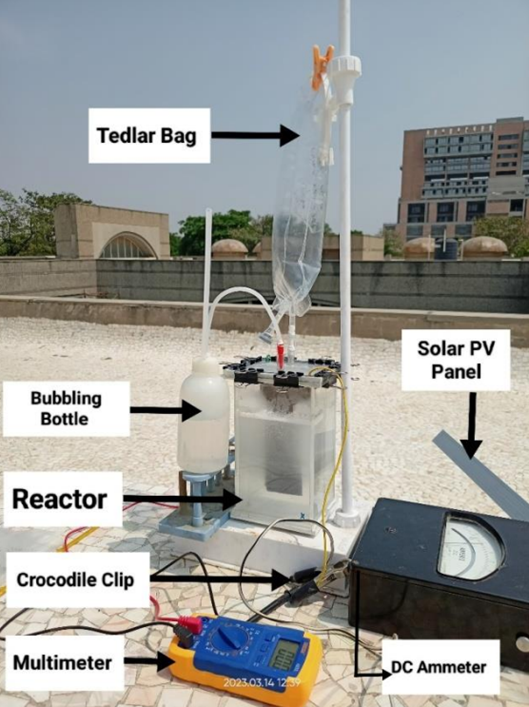

Image Source : nirmauni

Egypt:

Strong partnership with European investors to develop hydrogen and green ammonia.

Focus on Suez Canal Corridor to serve shipping and European markets.

Launched Egypt Vision 2030, integrating green hydrogen and ammonia projects.

Morocco:

Pioneering hydrogen and ammonia production for domestic use and export.

Strong EU cooperation due to geographic proximity.

Leveraging solar and wind resources, Morocco is developing a green hydrogen roadmap, fostering public-private partnerships, and signing export-oriented MOUs with the EU and Germany.

Algeria, Qatar, Kuwait: Exploring strategies, with Qatar leveraging its LNG infrastructure to explore blue hydrogen.

Regional Collaborations

Export Hubs MENA countries are working with Europe (notably Germany and the Netherlands), Japan, and South Korea on technology transfer, co-investment, and pilot trade corridors (e.g., green ammonia shipping).

Infrastructure and Investment

Investments are flowing into electrolyzer manufacturing, ammonia conversion facilities, port upgrades, and R&D centers—essential for scaling up supply chains and technology localization.

Types of Hydrogen Pathways Considered

Green Hydrogen: Preferred long-term solution due to emissions-free credentials.

Blue Hydrogen: Seen as a transition fuel in gas-rich states (Qatar, UAE, Saudi Arabia).

Hydrogen Derivatives: Export in the form of ammonia (easier to transport) and use in synthetic fuels.

Challenges and Opportunities Ahead

Challenges Ahead:

Cost Competitiveness: Although renewable energy is cheap, Hydrogen (especially green) remains more expensive than fossil alternatives; cost reductions need scaling, innovation, and favorable policy signals. electrolysis remains capital-intensive—MENA must aggressively lower costs.

Infrastructure Needs: Export terminals, shipping fleets, hydrogen pipelines, and storage systems require years of build-out.

Policy & Regulatory Frameworks: The region is still developing robust standards, certification schemes, and incentives.

Competition: Australia, Chile, and other regions are also vying to be hydrogen superpowers.

Water Scarcity: Electrolysis requires water, and in a water-stressed region, desalination must be integrated into projects.

Opportunities:

First-Mover Advantage: Early investments could grant MENA long-term leadership in hydrogen exports and technology development.

Industrial Carbon Sequestration: Hydrogen can help decarbonize sectors like chemicals, steel, and refining—major industries in the region.

Job Creation and Skills Development: New value chains (from electrolyzer assembly to export logistics) will create high-skilled jobs and entrepreneurial opportunities.

Export Markets: Europe’s hydrogen import demand could reach 10-20 million tons per year by 2050, and MENA is a key supplier due to short shipping routes.

Investments: Large hydrogen projects could provide thousands of jobs and attract foreign investment in technology, infrastructure, and skills development.

The Blueprints to Implement Hydrogen Strategies in The MENA region

MENA countries are tackling the challenges by:

- Investing in pilot-to-gigascale projects with international partners.

- Forming alliances with Europe, Asia, and international organizations for technology transfer and offtake agreements.

- Developing hydrogen clusters and industrial zones near ports for integrated value chains.

- Building regulatory systems for hydrogen certification, especially to meet EU carbon-intensity standards.

Summary

The Roadmap Ahead

Hydrogen offers MENA a pathway to sustainable economic diversification, global energy leadership, and meaningful climate action, though realizing this potential will require coordinated investment, policy, and international collaboration.

The MENA region is at a strategic crossroads. By harnessing its natural advantages and investing heavily in hydrogen, it can reposition itself as a leader in the global low-carbon landscape. Ongoing pilot projects, the roll-out of supportive policies, export agreements, and private sector engagement will be decisive in scaling up and realizing the region’s hydrogen ambitions. Hydrogen strategies in the MENA region signify a **paradigm shift**—from being hydrocarbon exporters to becoming global leaders in **zero-carbon energy solutions!

Join Us,

We promote a shared commitment to provide healthy and safe environment for our Globe and also in the workplace. Our platform facilitates conversations among employers, employees, and safety experts, encouraging mutual learning and collective action. Our goal is to improve work environments and foster a culture of safety from understanding the latest legislation and standards to implementing effective safety protocols.

Join us and unlock a world of online courses in Mechanical Engineering, Occupational Health and Safety, Fire Safety, and Environment and Sustainability. Propel your career to new heights.

Connect now and take the next step toward professional excellence!

+91 7569034271

Let’s connect together on: Facebook, YouTube, LinkedIn, and Instagram.